Shares Outstanding Number of shares that are currently held by investors, including restricted shares owned by the company's officers and insiders as well as those held by the public. For companies with multiple common share classes, market capitalization includes both classes. Market Cap is calculated by multiplying the number of shares outstanding by the stock's price. Market Capitalization Reflects the total market value of a company. Earnings Per Share (TTM) A company's net income for the trailing twelve month period expressed as a dollar amount per fully diluted shares outstanding. P/E Ratio (TTM) The Price to Earnings (P/E) ratio, a key valuation measure, is calculated by dividing the stock's most recent closing price by the sum of the diluted earnings per share from continuing operations for the trailing 12 month period. Vir Biotechnology, Digital World Acquisition, Apple: What to Watch in the Stock Market TodayĪlibaba, MongoDB, PagerDuty, Yext: What to Watch When the Stock Market Opens Todayīitcoin, Virgin Galactic, Chewy, Quanta: What to Watch When the Stock Market Opens Today The Stock Is Sinking.ĭocuSign Stock Plummets. Systematic retrieval of data or other content from, whether to create or compile, post to other websites, directly or indirectly, as text, video or audio, a collection, compilation, database or directory, is prohibited absent our express prior written consent.DocuSign Stock Sinks After a Guidance CutĭocuSign Shares Fall on Disappointing EarningsĭocuSign Shares Rebound as CEO Dan Springer Buys $4.8 Million in StockĭocuSign Shares Fall More Than 40% as Customer Behavior ShiftsĭocuSign Delivers 'Big Whiff' on Billings Guidance.

Any other use, including for any commercial purposes, is strictly prohibited without our express prior written consent. You may use and the contents contained in solely for your own individual non-commercial and informational purposes only. Liable for your own investment decisions and agree to the Users should not base their investment decision upon. is a research service that provides financial data and technical analysis of publicly traded stocks.Īll users should speak with their financial advisor before buying or selling any securities. We therefore hold a negative evaluation of this stock. holds several negative signals and is within a very wide and falling trend, so we believe it will still perform weakly in the next couple of days or weeks. Our systems sees the trading risk/reward intra-day as attractive and believe profit can be made before the stock reaches first resistance.ĭocuSign, Inc. Since the stock is closer to the support from accumulated volume at $60.47 (0.13%)

#Market watch docusign full

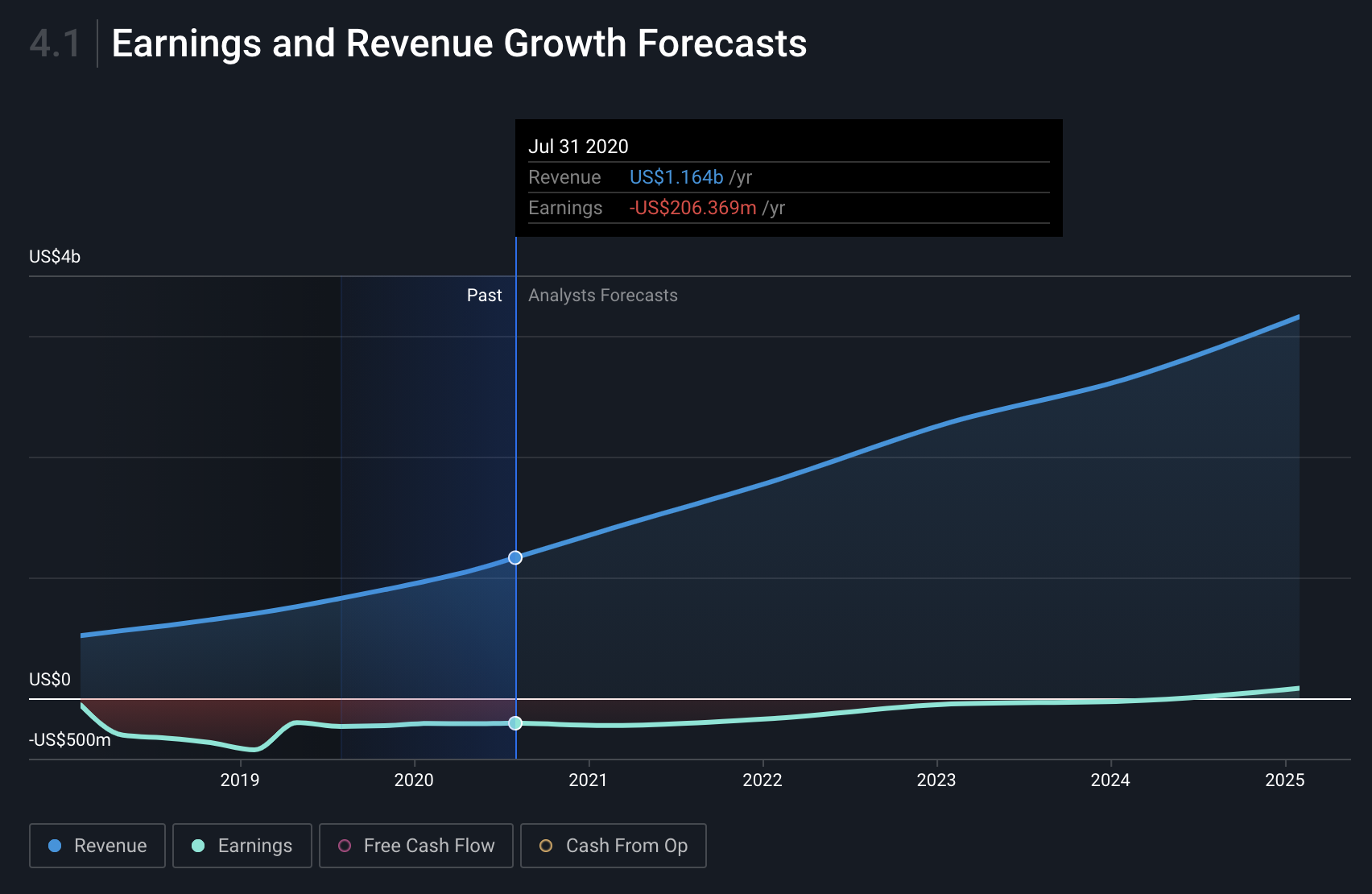

takes out the full calculated possible swing range there will be an estimated 21.63% move between the lowest and the highest trading price during the day. Which gives a possible trading interval of +/-$6.55 (+/-10.81%) up or down from last closing price. to open at $59.47, and during day (based on 14 day Average True Range), Trading Expectations For The Upcoming Trading Day Of Tuesday 21stįor the upcoming trading day on Tuesday 21st we expect DocuSign, Inc. We hold a negative evaluation for this stock. For the last week, the stock has had a daily average volatility of 7.40%.

During the last day, the stock moved $5.03 between high and low, or 8.92%. This stock may move very much during the day (volatility) and with a very large prediction interval from the Bollinger Band this stock is considered to be "very high risk". finds support from accumulated volume at $60.47 and this level may hold a buying opportunity as an upwards reaction can be expected when the support is being tested. Furthermore, there is currently a sell signal from the 3 month Moving Average Convergence Divergence (MACD). A break-up above any of these levels will issue buy signals. On corrections up, there will be some resistance from the lines at $63.93 and $76.27. Also, there is a general sell signal from the relation between the two signals where the long-term average is above the short-term average. stock holds sell signals from both short and long-term moving averages giving a more negative forecast for the stock. Some negative signals were issued as well, and these may have some influence on the near short-term development. This causes a divergence between volume and price and it may be an early warning. Volume fell during the last trading day despite gaining prices. Further rise is indicated until a new top pivot has been found. A buy signal was issued from a pivot bottom point on Thursday, June 16, 2022, and so far it has risen 6.58%.

0 kommentar(er)

0 kommentar(er)